Uber Stock: From The Billion Dollar Grave To The Cash Machine

Who would have thought when Uber went public in 2019 that I would ever invest in Uber shares? I certainly don't.

I've been a satisfied Uber customer since 2015 and have come to know the Uber driver service on many trips, both business and private, as an often superior alternative to taxis and rental cars.

But I've never been interested in buying Uber stock due to the company's years of massive losses. At the time of the IPO, I was actually quite opposed to the Uber share.

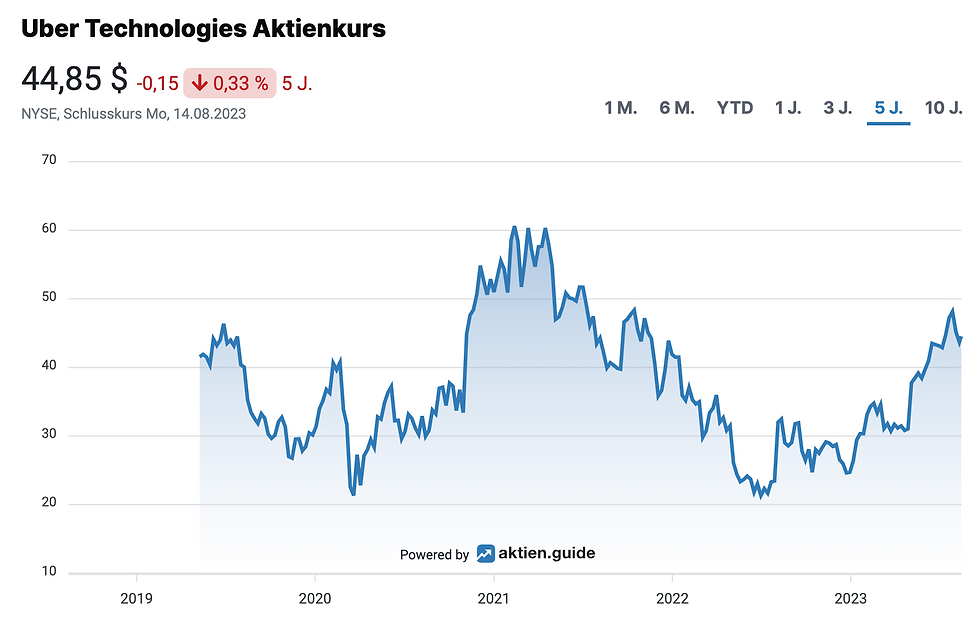

And in fact, since the IPO, Uber stock has not been a good investment for long-term shareholders. The current Uber share price of $44 is back today after a significant rebound where it was at the Uber IPO on May 10, 2019. Because the shares were then offered at an issue price of $45 per share.

With this Uber stock analysis, I explain my change of heart and why the Uber stock is from now on in my investable sample portfolio. It has - you guessed it - mainly to do with a remarkable turn-around in the result. But one thing at a time.

The Uber history

Uber was founded in March 2009 by Travis Kalanick and Garrett Camp in San Francisco. Their idea was to create a digital platform that would allow users to use an app to book private drivers for trips as a cheaper and more convenient alternative to taxis. Uber started its service in San Francisco and quickly began expanding to other cities and countries. From 2012 on they were also active in London, Paris, Sydney and Toronto. Just 6 years after it was founded, Uber already reached billions in sales in 2015.

In addition to disruptive growth and technological innovations, the development of Uber has always been characterized by legal disputes and controversial discussions about the company's business model. The taxi lobby in Germany, for example, has been fighting Uber very successfully for many years.

To date, Uber has encountered regulatory issues in this country due to its placement of unlicensed drivers, which conflicts with existing passenger transportation laws. In Germany mediates Uber therefore currently only trips to licensed rental car companies and can therefore not develop its full potential to this day.

How does Uber make its money?

The business model of the Uber platform is based on 3 main services:

Uber Mobility - Transportation

Uber Delivery - Food and Grocery Delivery Service

Uber Freight - Logistics platform

What all businesses have in common is that Uber does not own any physical assets (such as cars or trucks) and derives its revenues only from commissions for the platform provided.

In essence, Uber is the middleman between the supply side (driver, courier, trucking company) and the demand side (customers), making the connection and in return retaining a portion of the revenue paid by the customer for the service. The take rate is usually around 25-30%, i.e. Uber basically operates - in contrast to a SaaS company - with low gross profit margins.

Uber Mobility

Uber's main source of revenue is the ride-sharing service, with which the company was originally known, accounting for around 50% of total sales ($4.1 billion in 2022). Uber has few competitors in the ridesharing industry as they entered the market first and have successfully maintained their position through their brand name and aggressive advertising ever since. Today, Uber is active in over 70 countries and more than 10,000 cities worldwide.

A duopoly has developed in the most important US market. Uber has gained significant market share over the past 12 months, reaching 74% share, while challenger Lyft has to settle for 26%.

Uber Delivery

The second major revenue stream, with nearly $3 billion in 2022 revenue (about 1/3 of revenue), is Uber Eats, the restaurant delivery service. The company also offers its customers the option of having groceries delivered to their homes without having to leave their homes.

The meal delivery market is much more competitive than the ridesharing market. In the USA, for example, Uber controls with its brand Uber Eats 23% of the market, while market leader DoorDash has a staggering 65%. In Germany, Lieferando is after the withdrawal from Delivery Hero the (currently still) undisputed market leader. Uber Eats only entered the business here as a challenger in 2021, but is now already offering its services in over 100 German cities.

Due to its huge reach, Uber is also interesting as an additional sales channel for the large restaurant chains that operate their own delivery services. For example, Domino's announced an exclusive global partnership with Uber in July.

Uber Freight

Uber Freight was launched in May 2017 and accounted for 18% revenue share in the last fiscal year. It's a Uber-developed Logistics plattform. This connects forwarders and shippers with each other in order to make the transport of goods and freight easier and more efficient.

Uber Freight works similar to the traditional Uber model but focuses on the freight and logistics industry. The aim is to optimize and improve the process of matching available truck capacities with the shipping requirements of companies.

How Uber Freight works:

Consignors post loads that need to be transported on the platform. You provide information such as cargo type, pickup and delivery locations, delivery time frame, and other details. Carriers (truck drivers or transport companies) can browse and select the available loads that suit their capacities and routes.

Prices for transport are displayed on the platform. Carriers can accept or reject the prices and the exact terms of the cargo. Once a carrier accepts a load, the contract between the shipper and the carrier is completed via the platform.

During transit, senders, carriers and recipients can track the progress of the delivery in real time. The platform also allows communication between all stakeholders to share information and make any adjustments.

After successful delivery, payment will be processed by Uber Freight. The platform takes care of the payment to the carrier according to the agreed conditions.

With its digital offering, Uber Freight is successfully disrupting the often analog processes in the logistics industry. At the touch of a button in the app, shippers can immediately book the load they want to transport. And thanks to the fare displayed in advance, hauliers always know how much revenue they will make from the transport.

Legacy and management problems

Co-founder Travis Kalanick has long served as CEO at Uber. In 2017, however, he faced criticism amid various controversies and internal issues. These controversies covered issues such as company culture, business practices and his personal conduct. Due to increasing pressure from investors, Travis Kalanick resigned as CEO in June 2017 and also left the board in 2019.

Today's CEO Dara Khosrowshahi came from Expedia in 2017, where he previously served as CEO, and was selected to lead Uber during a period of restructuring.

The corona pandemic fell right in the middle of this restructuring and Uber had to struggle with falling passenger numbers. During this time, Uber Eats became increasingly important. After the pandemic, the new management quickly brought Uber back on a profitable growth path. But more on that later.

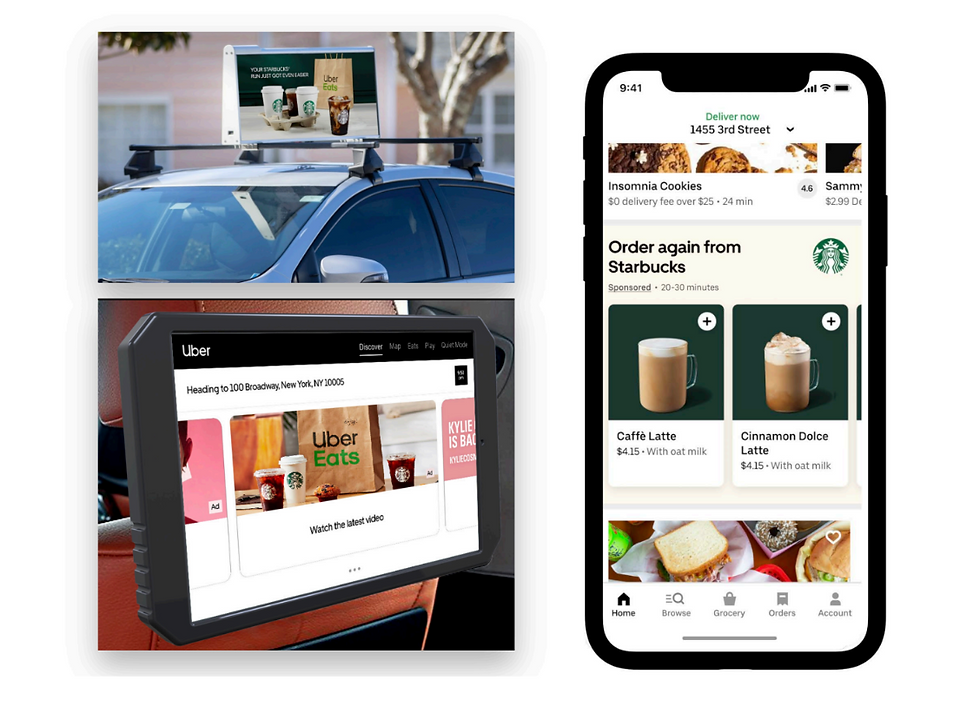

Advertising on the Uber platform

For some time now, Uber has discovered the advertising business as an additional revenue stream for its platform.

Just 3 years after the launch, from 2024 on various formats (in the Uber App, on and in the Uber cars) shall generate more than $1 billion in sales with advertising, which would be a sales share of 2-3%.

Advertising is thus becoming a very interesting add-on business for the Uber platform, which is used to monetize the enormous reach of the last 137 million monthly active end customers.

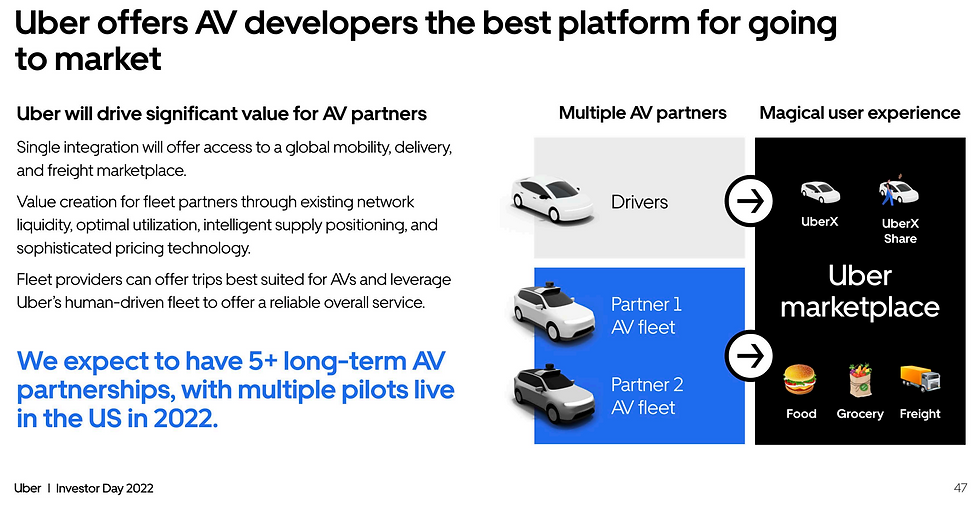

Uber partnership with Waymo

Uber tried to develop its own autonomous vehicle (AV) technology from 2015 to 2020. However, Uber's efforts in the field of autonomous vehicles ultimately failed due to the technical challenges. In December 2020, Uber sold its loss-making AV division.

A few months ago, Uber's strategic partnership with Waymo was announced with the aim of using the leading AV technology from the Google sister company on the Uber platform. In a first step, Uber customers in Phoenix, Arizona, will be able to order a driverless Waymo vehicle in the Uber and Uber Eats apps by the end of 2023.

This partnership gives a glimpse of what Uber's long-term future will looks like in the AV age. The Uber management has made it clear that this is not an exclusive partnership with Waymo, i.e. Uber intends to enter into such cooperations with other AV providers in the future.

In the AV age, when people are transported with Uber, the driver will no longer get up to 75% of the fare, but the money will be divided between the AV fleet provider (Waymo in this case) and Uber.

I assume that the gross margin (currently below 30%) at Uber will increase in the long term, also due to the transition to such an AV business model. However, it will probably be many years before this effect becomes apparent in the business figures.

The Uber business figures in 2023

While the development towards driverless Uber will be very slow, the Uber management can already report decisive progress towards a profitable, growing mobility giant.

For a long time, many market observers (including myself) were unsure whether Uber would ever become sustainably profitable given its low gross margins and expensive marketing. That has changed in the last 12 months.

Now, after successfully clearing up the legacy and overcoming the pandemic, it can be seen that Dara Khosrowshahi and his team have actually managed to form a real cash machine, despite all the difficulties and additional regulatory obstacles.

In the first half of 2023, Uber was able to multiply its free cash flow compared to the same period last year to approximately $1.7 billion. As of now, we can probably expect the Uber platform to generate at least $1 billion in cash flow each quarter.

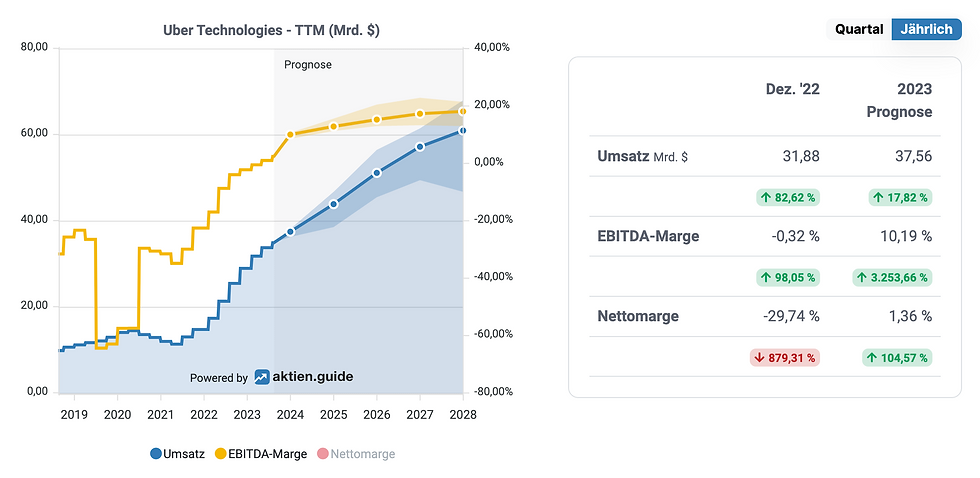

With sales of around $38 billion in 2023 and growth rates of over 15%, this immediately corresponds to a double-digit cash flow margin. A FCF margin of even 13% was reported for Q2 2023.

Uber stock valuation

With Uber stock priced at $44, the company trades at an enterprise value of $96 billion. The EV/Sales ratio of 2.7 (TTM) seems fair to me given the clearly double-digit growth and considering the comparatively low gross margin.

The cash flow multiple (EV/FCF simply explained here) should currently be 49 (TTM) abd ist set to drop below 25 over the next 12 months, assuming Uber actually generates $1 billion per quarter in cash flow.

Even not a bargain, but not too expensive considering the great market position that Uber holds in the mobility market with its strong brand and huge network effects.

Conclusion on the Uber stock analysis

After Airbnb I added now also Uber as the second market leader in the sharing economy to my High-Tech Stock Picking wikifolio (with a smaller entry position). I think the large network effects provide these companies with a valuable moat that will make Uber and Airbnb very difficult to attack for the foreseeable future.

As a shareholder, you should not expect too much from either investment in the short term, because these shares are not bargains and are rather fairly valued. Like Airbnb, Uber is not a speculation on a fast doubler for me. Rather, these shares are intended to bring some stability to a pure tech portfolio and are intended as a long-term investment with a target return of around 15-20% p.a.

I will patiently wait for a pullback and then cautiously increase position.

If you want to follow the development of Uber and Airbnb with me in the future, you can order my free newsletter here.

Disclaimer

The author and/or related individuals or companies own shares in Uber and Airbnb. This article is an expression of opinion and not investment advice. Please note the legal information.